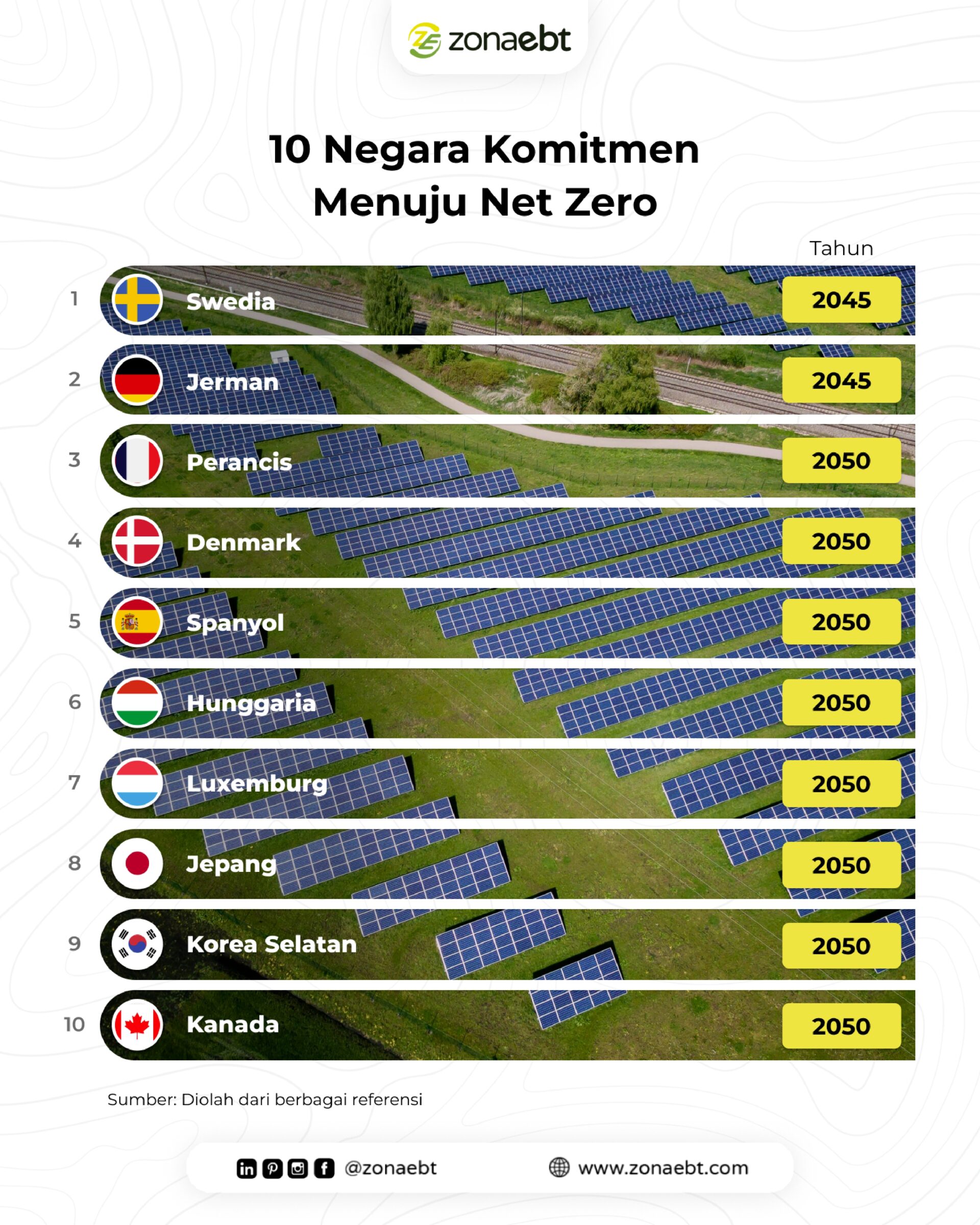

- Sweden targets net-zero emissions by 2045

- Sweden imposes the highest carbon tax of around US$125 per ton of CO₂ equivalent in 2023

- Sweden’s carbon tax has successfully reduced carbon emissions and had no negative impact on the country’s economy

In 2017, Sweden passed the Climate Act, which demonstrates Sweden’s commitment to achieving net zero emissions by 2045. It contains Sweden’s climate policy framework. It is the most important climate reform in Sweden’s history and the implementation of the Paris Agreement.

Did you know that as part of the European Union (EU), Sweden has big ambitions to become an environmentally friendly country. The ambitious form is to target net zero greenhouse gas emissions by 2045 as shown in the picture above through the Climate Act.

Baca Juga

- EU ETS: The Biggest Carbon Market in The World

- The United States: a Giant of Carbon Capture and Storage

Sweden Climate Act

Sweden’s Climate Act stipulates that all climate policy must be based on climate targets; the Government is required to present a climate report every year in its Budget Bill; every fourth year, the Government is required to draw up a climate policy action plan to describe how the climate goals are to be achieved; Climate policy goals and budget policy goals must work together.

The climate goals to be achieved are by 2045, Sweden is to have zero net emissions of greenhouse gasses into the atmosphere. This means that greenhouse gas emissions from activities in Sweden should be at least 85% lower than in 1990.

The remaining 15 % can be achieved through supplementary measures such as increased carbon sequestration in forest and land, carbon capture and storage technologies (CCS) and emission reduction efforts outside of Sweden. After 2045 Sweden should achieve negative emissions, meaning that the amount of greenhouse gas emitted is less than what can be reduced through the natural eco-cycle or through supplementary measures.

Then by 2030, emissions from domestic transport will be reduced by at least 70% compared with 2010. And by 2030, emissions in Sweden in the sectors covered by the EU Effort Sharing Regulation should be at least 63% lower than in 1990, out of which 8% may be achieved through supplementary measures.

In addition by 2040, emissions in Sweden in the sectors that will be covered by the EU Effort Sharing Regulation should be at least 75% lower than in 1990, out of which 2% may be achieved through supplementary measures. In realizing net zero emissions, Sweden implemented a carbon tax that successfully reduced the carbon produced.

Sweden Carbon Tax

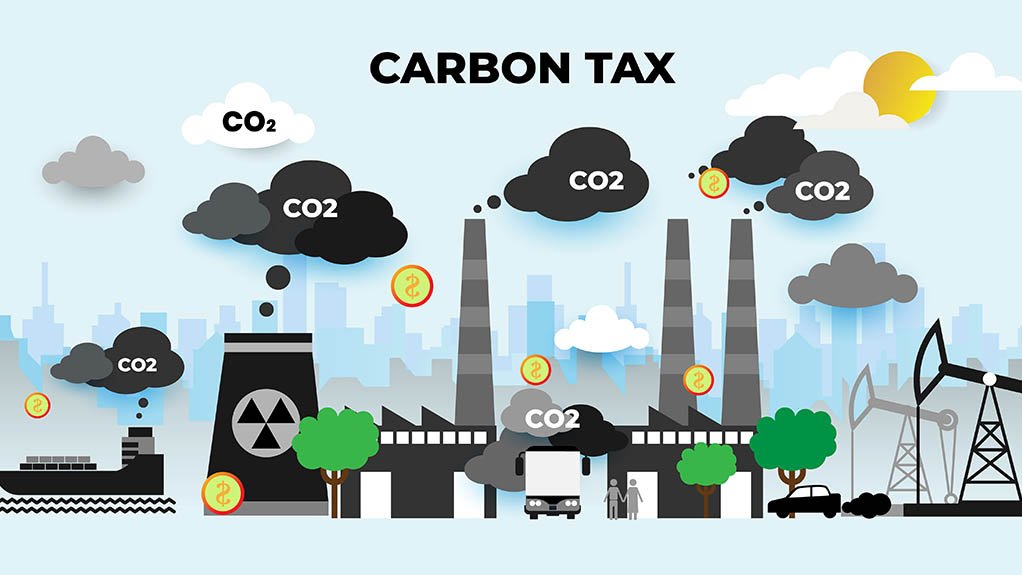

The best system for reducing carbon emissions is carbon pricing. In general, carbon pricing is putting a price on every carbon emission produced. One form of carbon pricing is a carbon tax.

Carbon tax is the most efficient carbon pricing mechanism because the government simply sets a tariff for each carbon emitted. This scheme is recommended by many economists, especially for countries that have big targets in reducing carbon emissions.

A carbon tax will generally be imposed on any economic activity that generates carbon emissions, both production and consumption activities. On the production side, the carbon tax will be imposed on manufacturers who produce carbon emissions in the manufacturing process, while on the consumption side, the carbon tax will be imposed on the use of goods/services that produce carbon emissions. The imposition of this carbon tax is aimed at reducing carbon emissions that can cause global climate change.

Sweden has the highest carbon tax rate in the world. In 1991, Sweden began implementing a carbon tax at a rate of $26 per ton of CO₂ equivalent. And it continues to increase over time. According to the Tax Foundation, Sweden has a carbon tax rate of $125.56 per ton of CO₂ equivalent. Furthermore, this will be the third largest tax rate in the EU by 2023.

Sweden’s carbon tax regulations have changed repeatedly over the past 30 years. At its inception in 1991, Sweden set a rate of $26 per ton of CO₂ equivalent. It then increased dramatically from 2000 to 2004. In 2000, the Swedish government raised the carbon tax rate from $26 to $32 per ton of CO₂ equivalent and in 2004 it was raised again to $95 per ton of CO₂ equivalent. The rate continued to slowly increase until in 2023 it reached $125.56 per ton of CO₂ equivalent.

The Swedish government only imposes a carbon tax on fossil fuels for transportation and heating purposes. Some examples of sectors that are exempted from carbon taxation are the industrial sector, mining sector, agricultural sector, and forestry sector. This exemption aims to maintain the condition of the Swedish economy. However, the Swedish government still requires these sectors to pay for their emissions through a carbon trading scheme known as the European Union Emission Trading Scheme (EU ETS).

Implementation of Carbon Tax in Sweden

Sweden’s high carbon tax rate has resulted in very high carbon tax revenues. In 2019, Sweden collected $2.3 billion in carbon tax revenues. The carbon tax is actually one of several levies on carbon emissions implemented by the Swedish government.

Other levies on fossil fuels in Sweden are energy tax, aviation tax, carbon trading (EU ETS), and vehicle tax. The number of levies shows that Sweden is really serious in dealing with environmental issues, especially issues related to global warming caused by carbon emissions.

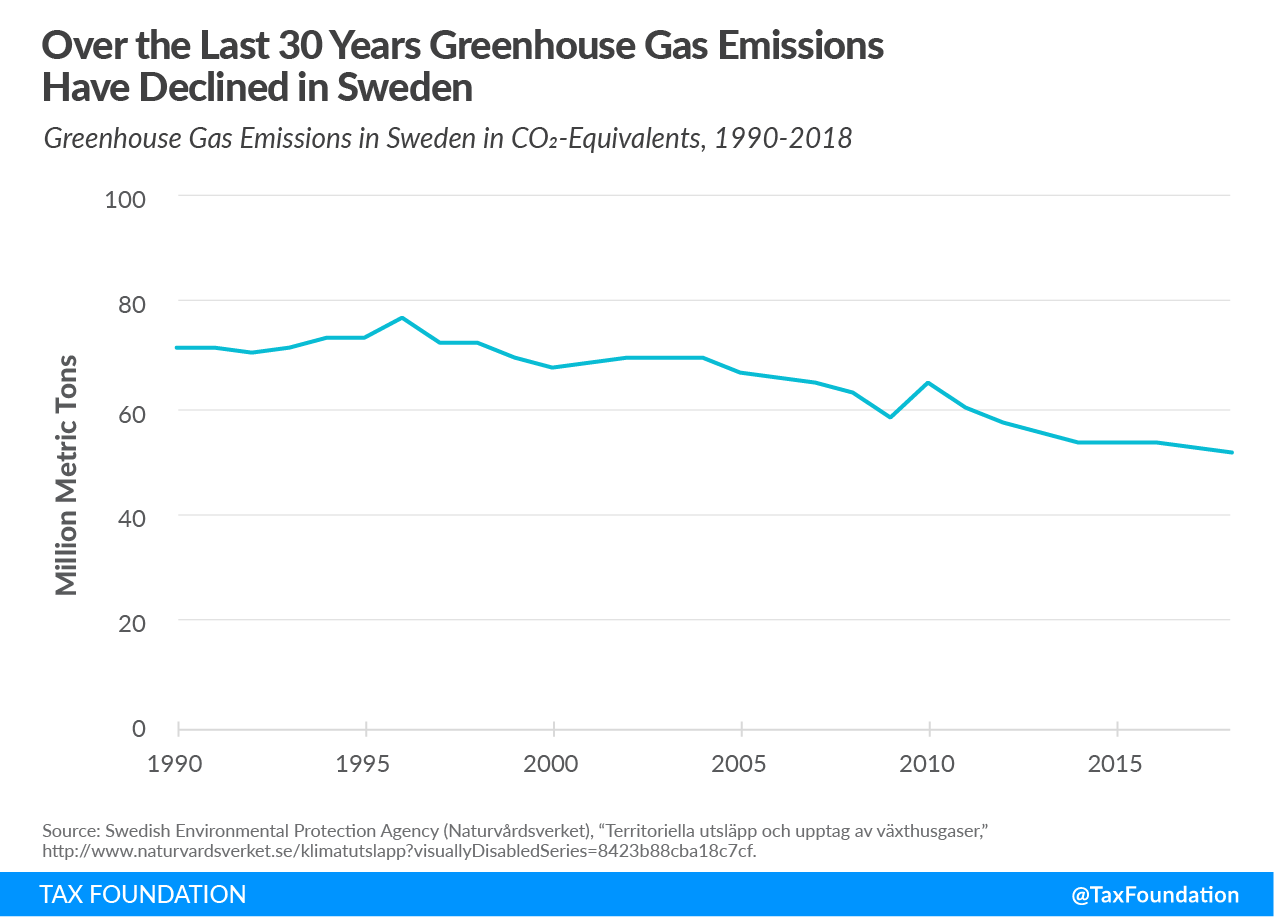

Sweden is a country that has successfully implemented a carbon tax. Since its implementation in 1991 until 2018, Sweden has managed to reduce carbon emissions by 27%, with the largest reduction occurring in early 2000. This significant reduction is believed to have occurred due to a significant increase in Sweden’s carbon tax rate in 2000.

The carbon tax designed by Sweden succeeded in reducing carbon emissions and did not have a negative impact on the country’s economy. This is due to other policies implemented by Sweden to offset the negative impact of the carbon tax.

The policy of lowering income tax rates and eliminating several other types of taxes is done so that people do not bear too much tax burden so that the economy can still run. With the reduction of income tax rates and the elimination of several types of taxes, Sweden has experienced a decrease in tax revenue sources as a result of which all revenues from carbon taxes will be used to cover tax revenues, so that the Swedish Government still has sufficient funds to carry out government functions.

Baca Juga

- Potensi Global? Ini Total Penyimpanan Karbon Milik Indonesia

- Peran Pengukuran Karbon dalam Keberlanjutan Lingkungan

So that’s how Sweden achieved net zero emission in 2045. Hopefully Indonesia can catch up with Sweden’s achievements ya Sobat EBT Heroes.

#zonaebt #EBTHeroes #Sebarterbarukan

Editor: Alvin Pratama

References

66 Comment

pin-up kazino https://azerbaijancuisine.com/# pin up casino azerbaycan

pin-up

buying from online mexican pharmacy mexican pharmacy northern doctors purple pharmacy mexico price list

mexican drugstore online mexican pharmacy northern doctors mexico pharmacies prescription drugs

mexican border pharmacies shipping to usa mexican pharmacy online mexican drugstore online

п»їbest mexican online pharmacies mexican pharmacy online mexican online pharmacies prescription drugs

https://northern-doctors.org/# mexico pharmacy

https://northern-doctors.org/# mexican pharmaceuticals online

buying prescription drugs in mexico online mexican northern doctors mexican rx online

mexico drug stores pharmacies: pharmacies in mexico that ship to usa – mexico pharmacy

http://northern-doctors.org/# mexican border pharmacies shipping to usa

mexican online pharmacies prescription drugs: mexican pharmacy – mexican online pharmacies prescription drugs

mexico pharmacy: northern doctors pharmacy – mexican border pharmacies shipping to usa

mexico drug stores pharmacies mexican pharmacy northern doctors mexico pharmacies prescription drugs

https://northern-doctors.org/# buying from online mexican pharmacy

https://northern-doctors.org/# mexico drug stores pharmacies

buying from online mexican pharmacy: mexican pharmacy – purple pharmacy mexico price list

https://northern-doctors.org/# medicine in mexico pharmacies

mexico drug stores pharmacies: mexican pharmacy – pharmacies in mexico that ship to usa

buying prescription drugs in mexico: northern doctors pharmacy – reputable mexican pharmacies online

https://northern-doctors.org/# medication from mexico pharmacy

mexican border pharmacies shipping to usa mexico drug stores pharmacies mexico drug stores pharmacies

pharmacies in mexico that ship to usa: mexican pharmacy northern doctors – п»їbest mexican online pharmacies

https://northern-doctors.org/# mexico pharmacy

п»їbest mexican online pharmacies: northern doctors pharmacy – best online pharmacies in mexico

buying prescription drugs in mexico online: mexican northern doctors – mexican pharmaceuticals online

https://northern-doctors.org/# buying from online mexican pharmacy

mexican rx online: northern doctors pharmacy – reputable mexican pharmacies online

mexican rx online: mexican pharmacy northern doctors – medicine in mexico pharmacies

http://northern-doctors.org/# medicine in mexico pharmacies

mexican mail order pharmacies mexico pharmacy mexico drug stores pharmacies

http://cmqpharma.com/# mexican pharmaceuticals online

purple pharmacy mexico price list

mexican mail order pharmacies online mexican pharmacy buying prescription drugs in mexico online

buying prescription drugs in mexico online: cmq pharma – pharmacies in mexico that ship to usa

mexican border pharmacies shipping to usa online mexican pharmacy mexican pharmacy

mexican drugstore online cmqpharma.com mexico pharmacies prescription drugs

medicine in mexico pharmacies cmqpharma.com buying prescription drugs in mexico

mexican drugstore online mexico pharmacy mexican rx online

purple pharmacy mexico price list mexican online pharmacy reputable mexican pharmacies online

mexico drug stores pharmacies cmq mexican pharmacy online buying prescription drugs in mexico online

mexican online pharmacies prescription drugs mexican pharmacy online pharmacies in mexico that ship to usa

pharmacies in mexico that ship to usa cmq pharma mexican mail order pharmacies

http://cmqpharma.com/# mexican online pharmacies prescription drugs

best online pharmacies in mexico

global pharmacy canada: onlinepharmaciescanada com – safe canadian pharmacy

https://canadapharmast.com/# canadian pharmacy online ship to usa

legal canadian pharmacy online: canadian pharmacy world – online pharmacy canada

indian pharmacy india online pharmacy Online medicine home delivery

purple pharmacy mexico price list: mexico pharmacies prescription drugs – purple pharmacy mexico price list

https://foruspharma.com/# mexican border pharmacies shipping to usa

mexican drugstore online mexican pharmacy mexican border pharmacies shipping to usa

buying prescription drugs in mexico online: reputable mexican pharmacies online – mexican pharmaceuticals online

canadianpharmacymeds: reliable canadian pharmacy – canadian compounding pharmacy

https://canadapharmast.com/# reputable canadian pharmacy

mexican mail order pharmacies buying prescription drugs in mexico medication from mexico pharmacy

medication from mexico pharmacy: mexico pharmacy – mexican rx online

world pharmacy india: Online medicine home delivery – indian pharmacies safe

http://amoxildelivery.pro/# amoxicillin 1000 mg capsule

can i get clomid: can i get generic clomid without a prescription – can you buy clomid without dr prescription

https://doxycyclinedelivery.pro/# doxycycline 100 mg tablet cost

https://ciprodelivery.pro/# antibiotics cipro

http://clomiddelivery.pro/# buying generic clomid prices

https://amoxildelivery.pro/# where to buy amoxicillin over the counter

https://amoxildelivery.pro/# where can i buy amoxicillin over the counter uk

http://amoxildelivery.pro/# where can i get amoxicillin

http://amoxildelivery.pro/# amoxicillin 500mg no prescription

http://amoxildelivery.pro/# cost of amoxicillin 30 capsules