- The European Union Emissions Trading System (EU ETS) is the world’s first international emissions trading system.

- It was established in 2005 and has grown rapidly in the carbon market.

- Revenues from the EU ETS support investments that help further reduce emissions.

Did you know the European Union Emissions Trading System (EU ETS) is the world’s first international carbon emissions trading system. The EU ETS is an effort to deal with climate change, especially reducing greenhouse gas emissions.

The EU ETS applies in all EU Member States, the European Free Trade Association countries (Iceland, Liechtenstein and Norway) as well as Northern Ireland for electricity generation. It covers greenhouse gas emissions from around 10,000 installations in the energy sector and manufacturing industry as well as aircraft operators flying within the EU and departing to Switzerland and the United Kingdom or around 40% of the EU’s emissions. Since its establishment in 2005, the EU ETS has helped reduce emissions from power plants and industry by 37%.

The EU with this carbon market has a target to achieve climate neutral by 2050. As a first milestone, the EU is aiming to reduce net emissions by at least 55% by 2030 compared to 1990. It’s interesting, that the carbon market makes an important contribution to reducing emissions. So, let’s see the next info.

Baca Juga

- Bursa Karbon Indonesia: Arah Baru Mengatasi Perubahan Iklim Global

- Jokowi Resmikan Bursa karbon Indonesia: Langkah Nyata Hadapi Krisis Iklim

How The Carbon Market Works

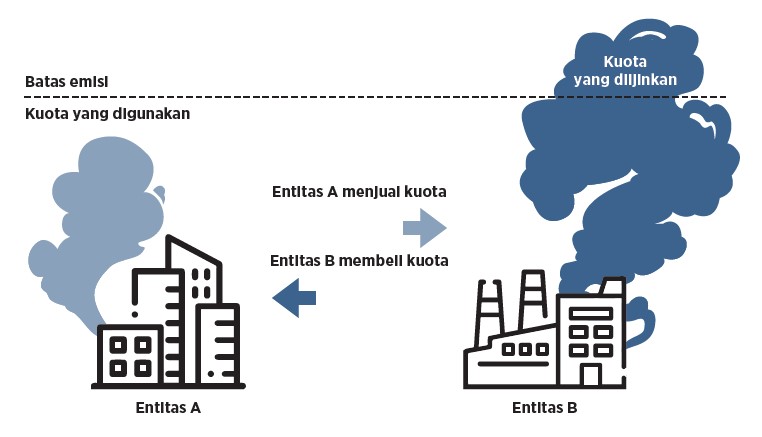

The EU ETS works on the ‘cap and trade’ principle. A cap is a limit on the total amount of greenhouse gasses that companies can emit. The cap is reduced annually in line with the EU’s climate change target, ensuring that emissions decrease over time. The cap is expressed in emission allowances, where one allowance gives the right to emit one ton of CO2eq (carbon dioxide equivalent).

Under the cap, companies primarily buy allowances on the EU carbon market, but they also receive some allowances for free. Companies can also trade allowances with each other as needed like the illustration below. If an installation or operator reduces its emissions, it can either keep the extra allowances for future use or sell them.

Under the cap, companies primarily buy allowances on the EU carbon market, but they also receive some allowances for free. Companies can also trade allowances with each other as needed like the illustration above. If an installation or operator reduces its emissions, it can either keep the extra allowances for future use or sell them.

The declining cap gives companies certainty about the long-term scarcity of allowances and ensures that allowances have a market value. The price of allowances acts as an incentive for companies to reduce emissions in the most cost-effective way. It also determines the revenue generated by the EU ETS from the sale of allowances. Since 2013, the EU ETS has generated more than €152 billion in revenue.

Revenues from the EU ETS support investments in renewable energy, energy efficiency improvements and low-carbon technologies that help further reduce emissions. Behind the term of the world’s first major carbon market and what remains the largest carbon market, the EU ETS has had a long journey in formulating it.

Development of the EU ETS Carbon Market

The 1997 Kyoto Protocol set legally binding emission reduction targets, or caps, for 37 industrialized countries for the first time. This led to the need for policy instruments to meet these targets.

In March 2000, the European Commission presented a Green Paper with initial ideas for the design of the EU ETS. It served as the basis for numerous stakeholder discussions that helped shape the system. The EU ETS Directive was adopted in 2003 and the system was launched in 2005. There EU ETS is organized in trading periods (or phases), of which four are currently decided and more may follow. Currently the system is in its third period. Each of the four is described below as follows:

Phase 1 (2005-2007), this was a three-year “learning by doing” pilot, during which the EU ETS had to function effectively to help the EU meet its Kyoto targets. Phase 1 succeeded in establishing a price for carbon, free trade in emission allowances across the EU, and the infrastructure needed to monitor, report, and verify emissions covered.

Phase 2 (2008-2012) coincided with the first commitment period of the Kyoto Protocol, during which countries in the EU ETS had to meet specific emission reduction targets. In this phase, the EU imposed a tighter emission cap by reducing the total volume of EU by 6.5% compared to 2005. The penalty for non-compliance increased to €100 per ton CO2eq.

Phase 3 (2013-2020), The reform of the ETS framework for this phase changed the system considerably compared to phases 1 and 2. The changes introduced in this phase particularly include the emission cap applying uniformly over the EU to achieve the green house gasses reduction target more effectively. The cap decreases by 1.74% per year to reduce emissions by 21% in 2020 compared to 2005.

Phase 4 (2021-2028), This phase will begin 1 January 2021 and finish on 31 December 2028 wherein the EC intends to conduct a full review of the EU ETS directive by the year 2026.

Baca Juga

- Bursa Karbon: Pasar Sekunder Jual Beli Kredit Karbon

- The United States: a Giant of Carbon Capture and Storage

The EU ETS system provides flexibility to covered entities by allowing them to choose between reducing emissions or purchasing emissions from other entities, depending on the price of carbon. This encourages the realization of low-cost GHG reductions while the costly reduction measures can be postponed.

So that’s it, Sobat EBT Heroes. From this article we can learn a lot about carbon trading in the EU and hopefully carbon trading in Indonesia can follow the success of the EU.

#zonaebt # Sebarterbarukan #EBTheroes

Editor: Alvin Pratama

References

[1] EU Emissions Trading System (EU ETS]

[2] The EU Emissions Trading System: an Introduction

[3] Bisa Tekan Emisi, Begini Penjelasan Mekanisme Perdagangan Karbon

70 Comment

It’s actually a nice and useful piece of info. I’m happy that you shared this helpful information with us.

Please keep us informed like this. Thank you for sharing.

Hi there, this weekend is fastidious in favor of me, because this point in time i am reading this great informative

article here at my house.

It’s fantastic that you are getting ideas from this paragraph as

well as from our dialogue made at this place.

Howdy I am so grateful I found your blog page, I really found

you by accident, while I was browsing on Askjeeve for something else, Nonetheless I am here now and would just like to say

many thanks for a incredible post and a all round exciting blog (I also

love the theme/design), I don’t have time to browse it all at the moment but

I have book-marked it and also added in your RSS feeds,

so when I have time I will be back to read a lot more, Please do keep up the fantastic work.

pin up az?rbaycan https://azerbaijancuisine.com/# pin up casino azerbaycan

pin up az?rbaycan

mexican pharmaceuticals online northern doctors mexico drug stores pharmacies

reputable mexican pharmacies online Mexico pharmacy that ship to usa mexican border pharmacies shipping to usa

http://northern-doctors.org/# pharmacies in mexico that ship to usa

http://northern-doctors.org/# mexican pharmaceuticals online

mexico pharmacies prescription drugs: northern doctors – mexican mail order pharmacies

http://northern-doctors.org/# pharmacies in mexico that ship to usa

mexican border pharmacies shipping to usa northern doctors pharmacy mexico drug stores pharmacies

buying prescription drugs in mexico online: mexican northern doctors – mexico pharmacy

buying prescription drugs in mexico online: Mexico pharmacy that ship to usa – buying prescription drugs in mexico online

https://northern-doctors.org/# mexican pharmaceuticals online

http://northern-doctors.org/# reputable mexican pharmacies online

http://northern-doctors.org/# mexico drug stores pharmacies

buying prescription drugs in mexico online: mexican pharmacy – purple pharmacy mexico price list

http://northern-doctors.org/# mexican mail order pharmacies

http://northern-doctors.org/# buying prescription drugs in mexico online

https://northern-doctors.org/# buying from online mexican pharmacy

mexico drug stores pharmacies Mexico pharmacy that ship to usa medication from mexico pharmacy

mexico drug stores pharmacies: mexican border pharmacies shipping to usa – mexican pharmaceuticals online

https://northern-doctors.org/# mexican online pharmacies prescription drugs

buying prescription drugs in mexico online: northern doctors pharmacy – buying prescription drugs in mexico

https://northern-doctors.org/# mexico drug stores pharmacies

best online pharmacies in mexico: mexican pharmacy online – mexican rx online

mexico drug stores pharmacies: mexican pharmacy – best online pharmacies in mexico

http://northern-doctors.org/# purple pharmacy mexico price list

http://northern-doctors.org/# mexican pharmacy

medicine in mexico pharmacies Mexico pharmacy that ship to usa medicine in mexico pharmacies

medication from mexico pharmacy mexican online pharmacy mexico drug stores pharmacies

mexico pharmacy cmqpharma.com mexican rx online

mexico drug stores pharmacies: cmqpharma.com – mexico pharmacy

mexican pharmaceuticals online cmqpharma.com mexican border pharmacies shipping to usa

mexico pharmacy online mexican pharmacy mexican drugstore online

mexican mail order pharmacies mexican online pharmacy reputable mexican pharmacies online

mexican online pharmacies prescription drugs mexican pharmacy online mexican pharmaceuticals online

mexican border pharmacies shipping to usa

https://cmqpharma.online/# mexico pharmacies prescription drugs

mexican pharmaceuticals online

purple pharmacy mexico price list cmq mexican pharmacy online best online pharmacies in mexico

mexico drug stores pharmacies mexican pharmacy mexican drugstore online

mexican pharmaceuticals online mexico pharmacy mexican rx online

canadian pharmacy: safe reliable canadian pharmacy – best canadian online pharmacy reviews

top 10 online pharmacy in india Online medicine order indian pharmacy paypal

reputable mexican pharmacies online: mexican online pharmacies prescription drugs – buying prescription drugs in mexico online

https://canadapharmast.com/# online canadian pharmacy

pharmacy website india: indian pharmacy – indian pharmacies safe

mexican drugstore online mexico drug stores pharmacies mexican online pharmacies prescription drugs

Greetings! Pretty helpful advice in this distinct write-up! It is the small modifications that can make the best modifications Many thanks a great deal for sharing!

mexico pharmacies prescription drugs: buying prescription drugs in mexico online – mexican rx online

reddit canadian pharmacy: best canadian online pharmacy reviews – canada drugstore pharmacy rx

https://foruspharma.com/# mexico pharmacies prescription drugs

canadian pharmacy no scripts canadian pharmacy victoza canadian pharmacy 24 com

canadian pharmacy prices: www canadianonlinepharmacy – best canadian pharmacy

п»їlegitimate online pharmacies india: indianpharmacy com – indian pharmacy

reputable canadian pharmacy canadian pharmacy ltd canadian family pharmacy

https://indiapharmast.com/# mail order pharmacy india

mexico drug stores pharmacies: mexican drugstore online – best online pharmacies in mexico

http://ciprodelivery.pro/# п»їcipro generic

http://clomiddelivery.pro/# where buy clomid without a prescription

https://amoxildelivery.pro/# amoxicillin 500

https://ciprodelivery.pro/# buy ciprofloxacin over the counter

https://ciprodelivery.pro/# antibiotics cipro

http://doxycyclinedelivery.pro/# buy doxycycline 100mg capsules online

https://clomiddelivery.pro/# generic clomid without a prescription

http://ciprodelivery.pro/# buy ciprofloxacin

http://amoxildelivery.pro/# amoxicillin 500 mg without a prescription