- Carbon exchange are a solution to reducing greenhouse gas emissions

- The pioneer countries of carbon exchanges are European Union, Switzerland, and New Zealand

- Indonesia has the best carbon exchange in Asia

Halo Sobat EBT, did you know that the term carbon exchange is very popular these days. Carbon exchange is a solution for countries around the world to reduce greenhouse gas emissions. Various carbon exchange schemes are implemented to achieve this goal.

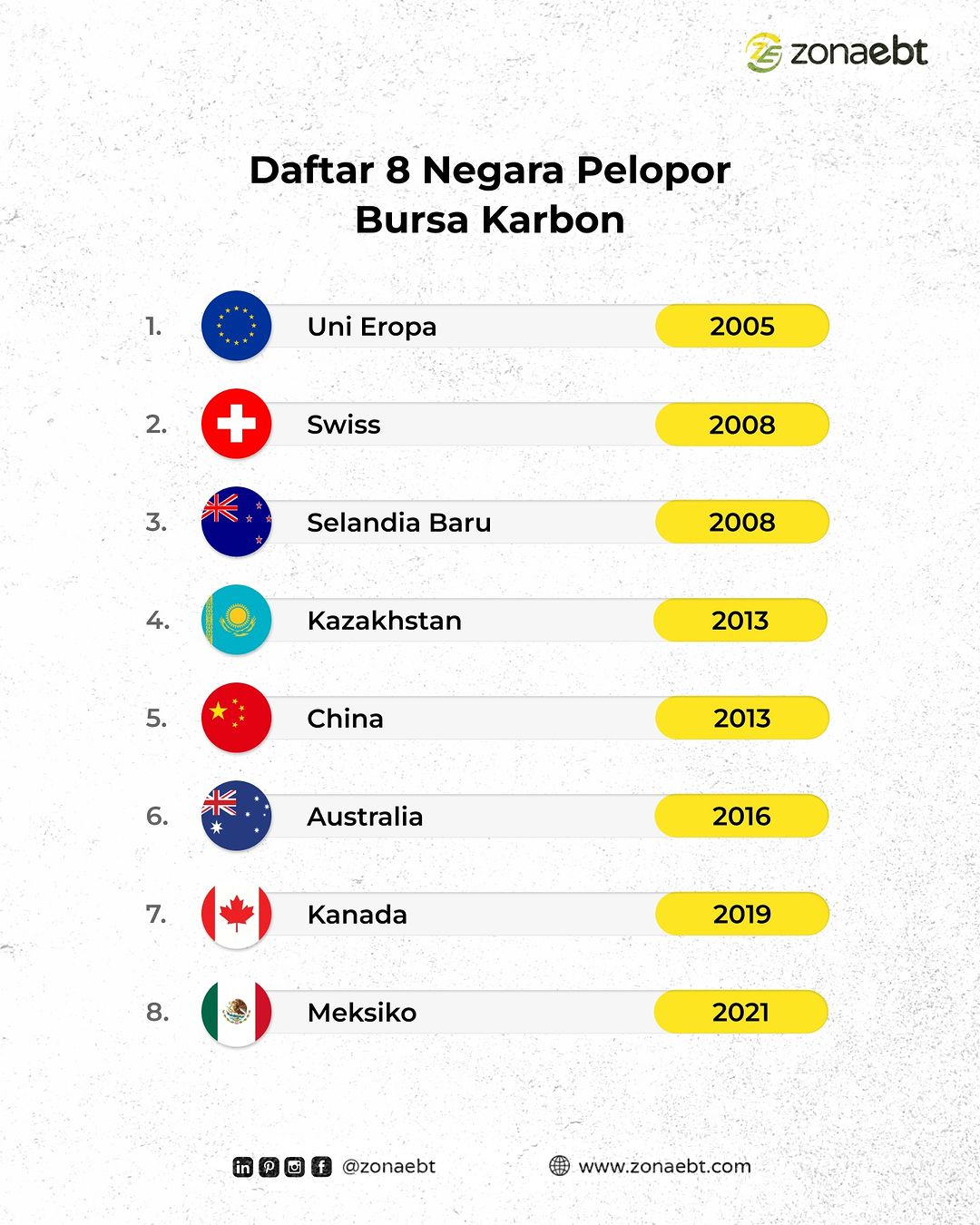

Indonesia has just launched a carbon exchange on September 26, 2023. This is historical for Indonesia because it can create a market to fund greenhouse gas emission reductions and become a major participant in global carbon trading. Countries that have pioneered carbon exchanges include the European Union, Switzerland, and New Zealand. Let’s see how the carbon exchange system works in these pioneering countries.

Baca Juga

European Union Carbon Exchange

Europe has the largest carbon trading system in the world, the European Union Emissions Trading System (EU ETS). The system covers EU member states covering a wide range of economic sectors, including major industries, energy and aviation. The EU ETS has been in operation since 2005 and has served as a model for many other countries in implementing carbon trading schemes.

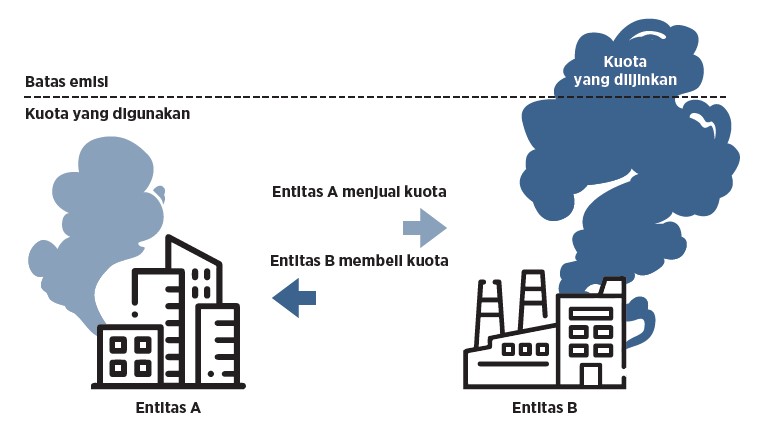

The EU ETS works on the ‘cap and trade’ principle. A cap is a limit on the total amount of greenhouse gasses that companies can emit. The cap is reduced annually in line with the EU’s climate change target, ensuring that emissions decrease over time. The cap is expressed in emission allowances, where one allowance gives the right to emit one ton of CO2eq (carbon dioxide equivalent).

Under the cap, companies primarily buy allowances on the EU carbon market, but they also receive some allowances for free. Companies can also trade allowances with each other as needed like the illustration above.

If an installation or operator reduces its emissions, it can either keep the extra allowances for future use or sell them. The EU ETS aims to achieve climate neutrality by 2050 and targets to reduce greenhouse gas emissions by at least 55% by 2030.

Switzerland Carbon Exchange

Switzerland introduced a CO2 tax on fossil fuels used in stationary sources in 2008. The levy covers around 40% of the country’s greenhouse gas emissions, primarily in the heating and process fuel sectors (fossil fuel for electricity generation – mainly small CHP and district heating – amounting to 1.2% of total generation). The levy is currently set at CHF 96 (EUR 89)/tonne of CO2 and from 2022, will be CHF 120/tonne.

Two-thirds of Switzerland’s carbon tax revenues are returned to households and businesses through reductions in health insurance charges and social security payments. This redistributive policy design reduces the burden of the policy cost on households. In 2018, the Swiss Federal Office for the Environment (FOEN) estimated that carbon tax revenues were CHF 1.2 billion (EUR 1.1 billion), and each Swiss resident received CHF 88.8 (EUR 82.5) via the redistribution policy.

From the introduction of the carbon tax until 2022, Switzerland’s total revenue reached EU 99.3 million (USD 104.6 million). Switzerland aims to achieve net zero emissions by 2050 with a target of reducing 50% of greenhouse gasses by 2030.

New Zealand Carbon Exchange

The New Zealand Emissions Trading Scheme or NZ ETS is the Government’s tool for reducing greenhouse gas emissions. The ETS does this by putting a price on climate pollution. As polluting becomes more expensive, companies and individuals are motivated to switch to cleaner alternatives.

The New Zealand Emissions Trading Scheme helps reduce emissions by doing three main things:

- Requiring businesses to measure and report on their greenhouse gas emissions

- Requiring businesses to surrender one ‘emissions unit’ (known as an NZU) to the Government for each one ton of emissions they emit

- Limiting the number of NZUs available to emitters (i.e. that are supplied into the scheme)

The Government sets and reduces the number of units supplied into the scheme over time. This limits the quantity that emitters can emit, in line with New Zealand’s emission reduction targets.

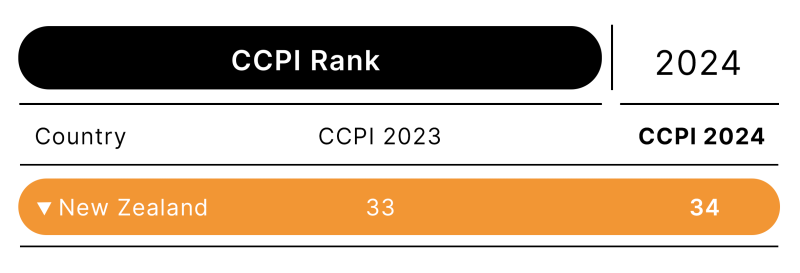

Despite being a pioneer in carbon trading, there are several barriers to implementation. This is evidenced by New Zealand’s ranking of 34th in the Climate Change Performance Index assessment.

This country has different rankings in the four main CCPI categories:

- high in renewable energy

- low in greenhouse gas emissions and climate policy

- very low in energy use

In order to meet New Zealand’s target of reducing emissions by 50% by 2030, the government has been tasked with including agriculture in the NZ ETS, completely banning oil and gas exploration, and shifting to more efficient and low-carbon energy production.

Indonesia Carbon Exchange

As one of the world’s largest greenhouse gas emitters, Indonesia is committed to achieving net zero emissions by 2060. The launch of the carbon market is evidence of Indonesia’s contribution to tackling the climate change crisis.

Indonesia’s carbon market is designed to facilitate the trading of carbon credits issued for projects or activities that reduce greenhouse gas emissions from the atmosphere. As well as for companies that produce carbon emissions below the threshold set by the government.

In simple terms, a carbon exchange is the buying and selling of greenhouse gas emission credits. Companies that are able to reduce emissions can sell carbon credits to companies that exceed emission limits.

Indonesia uses the Cap-Trade-Tax system. This system first sets a cap or allowance, then a trade, or carbon trading, and finally a tax, or carbon taxation. As a complex carbon exchange system, Cap-Trade-Tax was chosen to allow Indonesia to have carbon trading with integrity and transparency, and to prevent double counting of carbon.

Indonesia can make an important contribution not only in national interest but also in the international community as global emission reduction is very important.

Baca Juga

- Potensi Global? Ini Total Penyimpanan Karbon Milik Indonesia

- Peran Pengukuran Karbon dalam Keberlanjutan Lingkungan

So that’s all the information about carbon exchanges from various worlds, Sobat EBT Heroes. With many countries serious about reducing greenhouse gas emissions, hopefully this will be the first step in overcoming the climate change crisis.

#zonaebt #EBTHeroes #Sebarterbarukan

Editor: Alvin Pratama

References

[1] Emissions Cap and Allowances

[2] Swiss Carbon Tax

[3] Swiss ETS

Comment closed